The wine industry is bad and getting badder and Wine Australia keeps singing “Always Look on the Bright Side of Life”. Last month the Australian Bureau of Agricultural and Resource Economics and Sciences (ABARE) published a very gloomy forecast of wine’s economic future. Couched in vey temperate language the assessment still amounted to a strident criticism of Wine Australia which is also a federal government body,

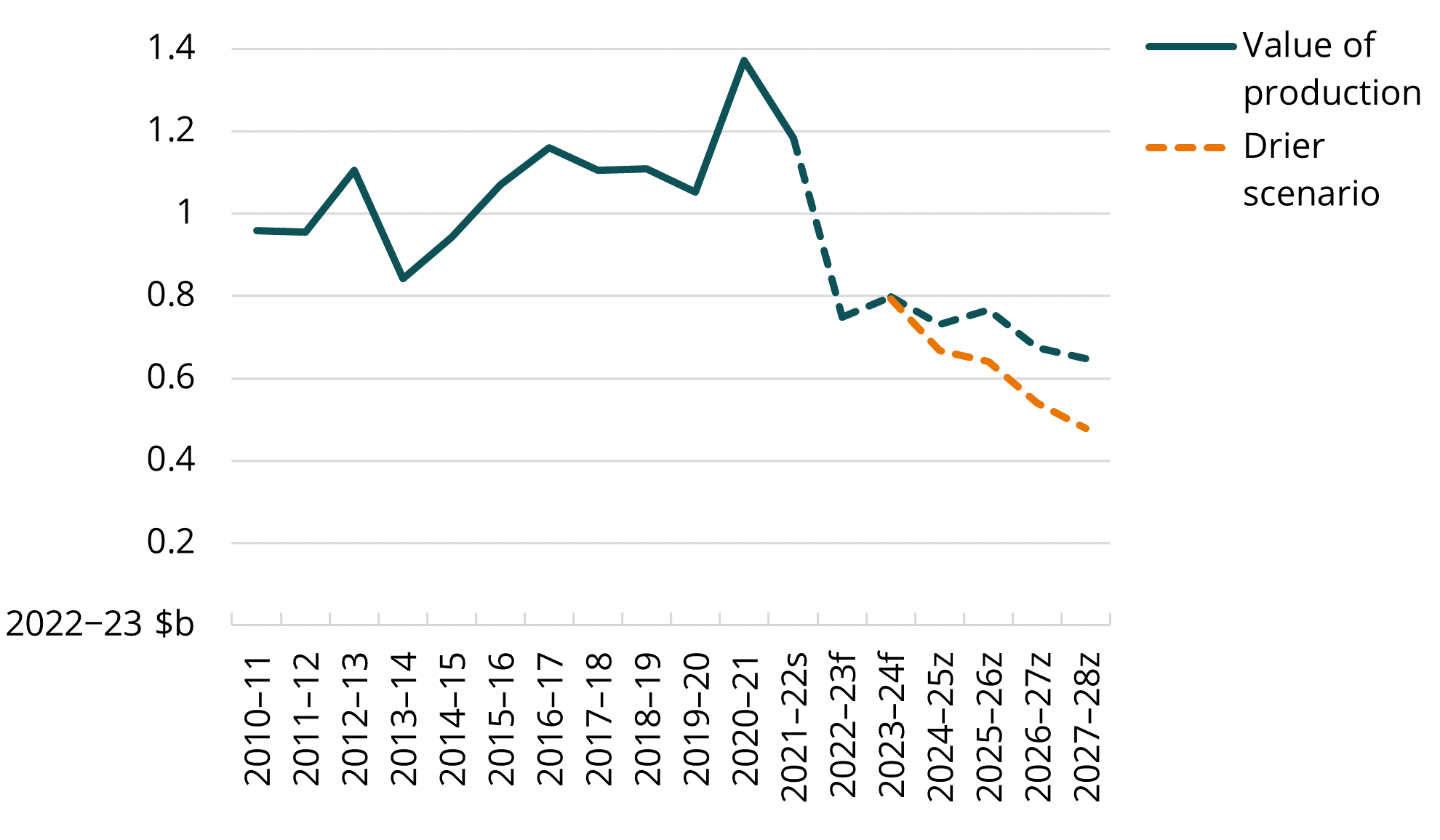

ABARE predicted that over the outlook period to 2027−28, the value of wine grape production is expected to fall to $647 million in real terms. “Yields are also expected to diminish over the outlook period in line with reduced rainfall compared to the last three years. In the drier scenario, it is expected that the value of wine grape production will fall rapidly to $478 million in real terms by 2027−28.”

Gross value of wine grape production, Australia, 2010−11 to 2027−28

Sources: ABARES; Wine Australia

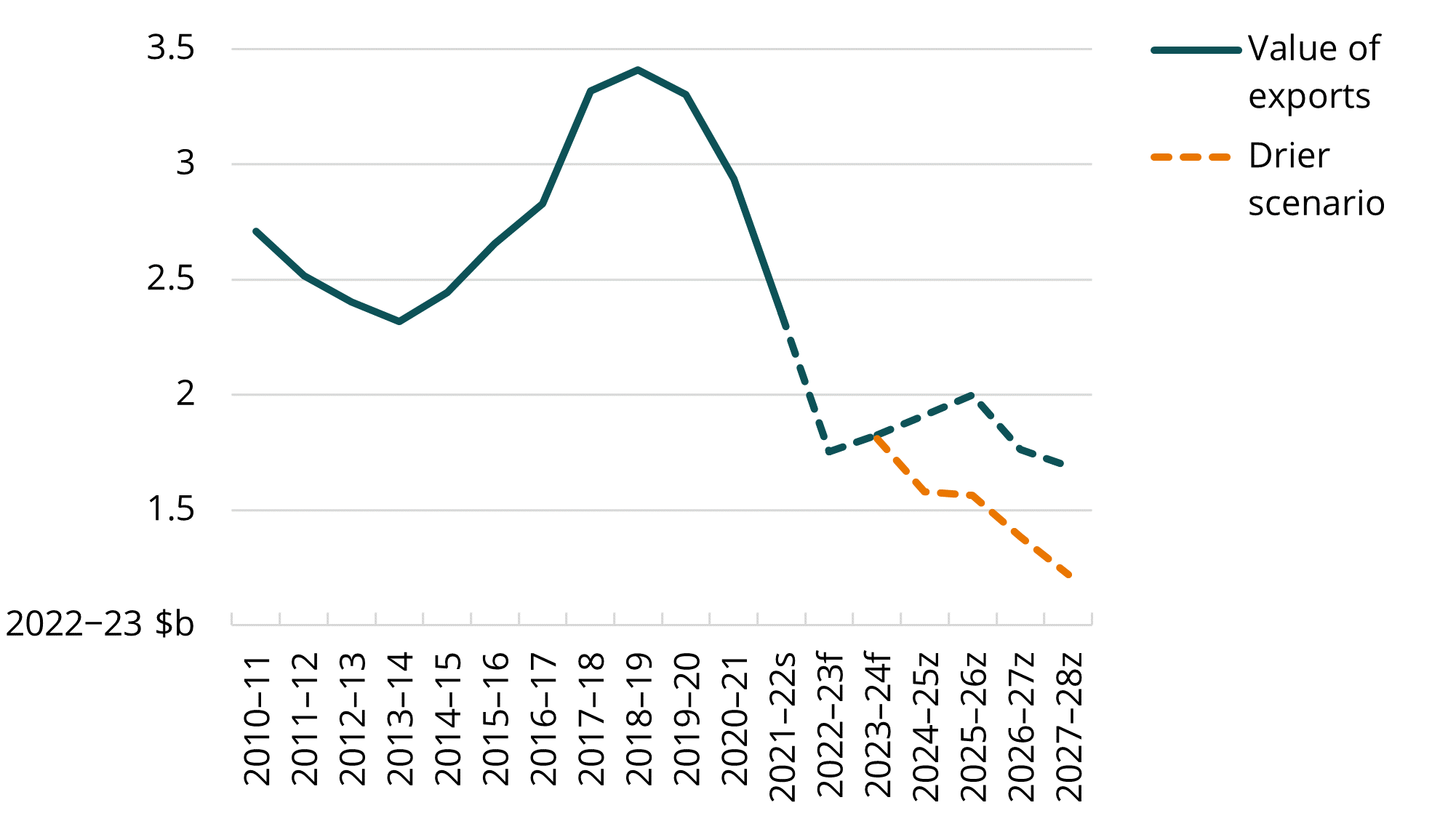

According to ABARE the value of wine exports will continue to fall – down 20% to $1.8 billion in 2022−23. Over the outlook period it is expected that exports will initially rise briefly before falling to around $1.7 billion in real terms by 2027−28 and by by 30% from 2022−23 to $1.2 billion in real terms by 2027−28 in its drier scanario.

Value of wine exports, Australia, 2010−11 to 2027−28

Sources: ABARES; ABS; Wine Australia

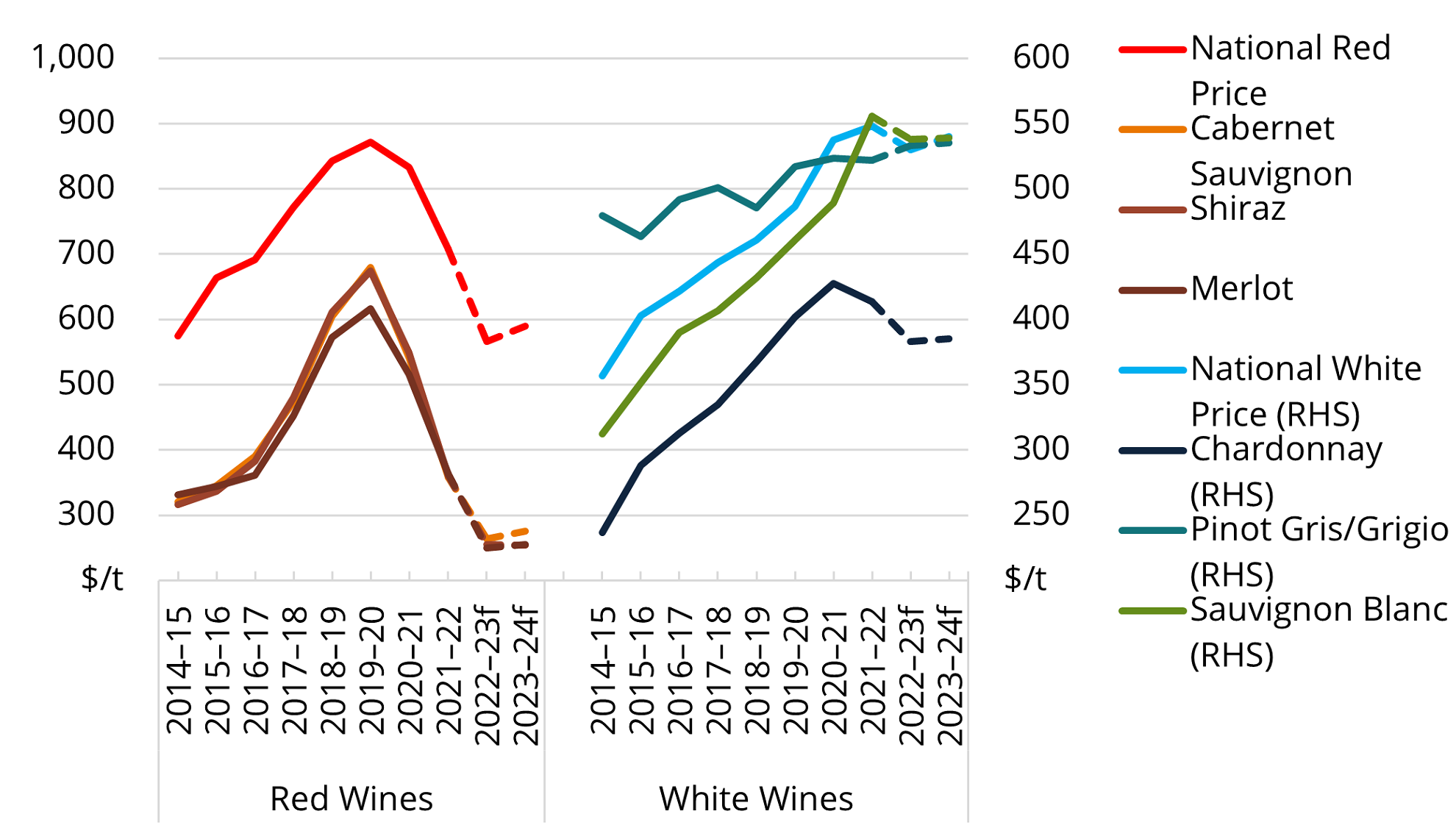

For grape growers, especially those with red varieties, the outlook is grim. The following graph shows that Australian wine grape prices normally track export prices quite closely. Over the outlook period it is expected that export prices will fall to $3 per litre in real terms. As the global economic recovery takes place, it is expected that discretionary expenditure in export destinations will begin to increase, raising demand for wine. However, global supply of red wine is expected to continue to outpace consumption and it is expected that red wine export prices will remain depressed.

Real grape price vs wine export price, Australia, 2014−15 to 2027−28

Sources: ABARES, ABS, Wine Australia

Wine grape prices, inland region vs national average, 2014−15 to 2023−24

Sources: ABARES; Wine Australia

Commenting on “Opportunities and Challenges” says there is potential for red wine prices to recover if domestic and international producers acknowledge the long−term decline in global red wine consumption and restructure to focus on higher value varieties such as white varietals. Additionally, greater value may be gained by Australian producers if they market their products towards younger demographics.

Wine Australia’s response is to find reasons why ABARE forecasts may prove to be wrong. “Overall,” it summarises, the reduction in the size of the winegrape crop forecast by ABARES in the forecast period may be on the high side. However, their overall modelling and assumptions on which it is based are sound and do reflect the reality of the very tough global economic outlook and a move into a drier climatic period. While the quantum of the forecast future tonnage is debatable, it does serve as an important stimulus for conversations about how the sector will respond to the challenges over the next five years.”

Forecasting is a notoriously imprecise business. Who knows which organisation wil be closest to the future mark but I am sure that grape growers hope Wine Australia has more success in stimulating their industry in the future than it has in the past.